Welcome back! Today we will explore how you can leverage pandas to understand trends in times series data quickly, with a particular focus on time series methods like pandas resample, grouping by dates, and performing rolling operations to smooth out the results. Along the way, I might grumble a bit (I’d like to think that the grey strands in my beard are from wisdom and not fighting with a computer), but I intend to give you some superpowers.

If you work with time series data, you will want to understand pandas resample, grouping, and rolling, as they will make your life much easier.

We will be running our example today with Ponder. Ponder lets you run pandas directly in your data warehouse. Throughout this post, you will see that you can continue writing your code in pandas with Ponder, while you get the scalability and security benefits that come with your data warehouse. You can learn more about Ponder in our recent blogpost and sign up here to try out Ponder today.

Try Ponder Today

Start running pandas and NumPy in your database within minutes!

Let’s start by picking a dataset that might be relevant considering recent news… bank failures.

Data Overview: FDIC BankFind Suite

In recent years, the banking sector in the United States has witnessed many financial institution failures, leading to substantial economic losses and systemic risks. The Federal Deposit Insurance Corporation (FDIC) bank failure data provides valuable insights into the underlying causes of these failures and helps develop effective risk management and regulatory compliance strategies. By exploring this data with the aid of the popular data analysis library, pandas, one can identify patterns and trends, prepare data for modeling, and visualize findings effectively.

BankFind Suite is a comprehensive database provided by the FDIC, which allows users to search for current and former FDIC-insured banking institutions based on name, FDIC certificate number, website, or location. This tool offers detailed information on an institution’s financial history and trends, enabling users to track the performance of individual institutions, groups of institutions, or the industry as a whole.

Let’s use the Bank Failure data to explore. I will download the data from 1934 to 2023 containing over 4000 entries.

Ponder uses your data warehouse as an engine, so we first establish a connection with Snowflake in order to start querying the data.

import json

import modin.pandas as pd

import ponder

import snowflake.connector

#Initalize Ponder

ponder.init()

# Load in your credentials

with open('cred.json') as fin:

kw = json.load(fin)

# Create a Snowflake connection

db_con = snowflake.connector.connect(**kw)df = pd.read_sql('bankfail', con=db_con)

df CERT CHCLASS1 CITYST COST FAILDATE FIN ID NAME QBFASSET QBFDEP RESTYPE RESTYPE1 SAVR

0 15426.0 NM ALMENA, KS 16806.0 10/23/2020 10538 4104 ALMENA STATE BANK 65733.0 64941.0 FAILURE PA DIF

1 16748.0 NM FORT WALTON BEACH, FL 7247.0 10/16/2020 10537 4103 FIRST CITY BANK OF FLORIDA 136566.0 133936.0 FAILURE PA DIF

2 14361.0 NM BARBOURSVILLE, WV 45913.0 4/3/2020 10536 4102 THE FIRST STATE BANK 151808.0 143102.0 FAILURE PA DIF

3 18265.0 NM ERICSON, NE 25293.0 2/14/2020 10535 4101 ERICSON STATE BANK 100879.0 95159.0 FAILURE PA DIF

4 21111.0 N NEWARK, NJ 1946.0 11/1/2019 10534 4100 CITY NATIONAL BANK OF NEW JERSEY 120574.0 111234.0 FAILURE PA DIF

... ... ... ... ... ... ... ... ... ... ... ... ... ...

4099 NaN NM LEWISPORT, KY NaN 8/6/1934 0 137 BANK OF LEWISPORT 81.0 68.0 FAILURE PO BIF

4100 NaN N LIMA, MT NaN 7/18/1934 0 135 FIRST NATIONAL BANK OF LIMA 91.0 42.0 FAILURE PO BIF

4101 NaN NM FLORENCE, IN NaN 7/18/1934 0 136 FLORENCE DEPOSIT BANK 105.0 69.0 FAILURE PO BIF

4102 NaN NM EAST PEORIA, IL NaN 5/28/1934 0 133 FON DU LAC STATE BANK 374.0 238.0 FAILURE PO BIF

4103 NaN NM PITTSBURGH, PA NaN 4/19/1934 0 134 BANK OF AMERICA TRUST CO. 1435.0 1064.0 FAILURE PO BIF

4104 rows × 13 columnsIt looks like my CSV export loaded ok. However, the existing column names are a little annoying. I’m going to clean them up.

Here’s some code to rename the columns, create a city and state column, and convert the date column to a datetime type.

colnames = {'CERT': 'cert',

'CHCLASS1': 'charter_class',

'CITYST': 'location',

'COST': 'estimated_loss',

'FAILDATE': 'effective_date',

'FIN': 'fin',

'ID': 'id',

'NAME': 'institution',

'QBFASSET': 'total_assets',

'QBFDEP': 'total_deposits',

'RESTYPE': 'resolution',

'RESTYPE1': 'transaction_type',

'SAVR': 'insurance_fund'}

def tweak_bank(df):

return (df

.assign(FAILDATE=pd.to_datetime(df.FAILDATE, format='%m/%d/%Y'),

city=df.CITYST.str.split(',').str[0],

state=df.CITYST.str.split(',').str[1],

)

.drop(columns=['CITYST'])

.rename(columns=colnames)

)

bank = tweak_bank(df)

bank cert charter_class estimated_loss effective_date fin id institution total_assets total_deposits resolution transaction_type insurance_fund city state

0 15426.0 NM 16806.0 2020-10-23 10538 4104 ALMENA STATE BANK 65733.0 64941.0 FAILURE PA DIF ALMENA KS

1 16748.0 NM 7247.0 2020-10-16 10537 4103 FIRST CITY BANK OF FLORIDA 136566.0 133936.0 FAILURE PA DIF FORT WALTON BEACH FL

2 14361.0 NM 45913.0 2020-04-03 10536 4102 THE FIRST STATE BANK 151808.0 143102.0 FAILURE PA DIF BARBOURSVILLE WV

3 18265.0 NM 25293.0 2020-02-14 10535 4101 ERICSON STATE BANK 100879.0 95159.0 FAILURE PA DIF ERICSON NE

4 21111.0 N 1946.0 2019-11-01 10534 4100 CITY NATIONAL BANK OF NEW JERSEY 120574.0 111234.0 FAILURE PA DIF NEWARK NJ

... ... ... ... ... ... ... ... ... ... ... ... ... ... ...

4099 NaN NM NaN 1934-08-06 0 137 BANK OF LEWISPORT 81.0 68.0 FAILURE PO BIF LEWISPORT KY

4100 NaN N NaN 1934-07-18 0 135 FIRST NATIONAL BANK OF LIMA 91.0 42.0 FAILURE PO BIF LIMA MT

4101 NaN NM NaN 1934-07-18 0 136 FLORENCE DEPOSIT BANK 105.0 69.0 FAILURE PO BIF FLORENCE IN

4102 NaN NM NaN 1934-05-28 0 133 FON DU LAC STATE BANK 374.0 238.0 FAILURE PO BIF EAST PEORIA IL

4103 NaN NM NaN 1934-04-19 0 134 BANK OF AMERICA TRUST CO. 1435.0 1064.0 FAILURE PO BIF PITTSBURGH PA

4104 rows × 14 columnsNot bad. This is going to be great data for learning pandas resample, groupby, and rolling.

Try Ponder Today

Start running your Python data science workflows in your database within minutes!

Data Dictionary

Here is the description of the columns for those (like me) who aren’t subject matter experts. (All descriptions taken from here.)

- cert – Certificate number assigned by FDIC to identify the institution

- charter_class – The FDIC assigns classification codes indicating an institution’s charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:

- N National chartered commercial bank supervised by the Office of the Comptroller of the

- SM State charter Fed member commercial bank supervised by the Federal Reserve

- NM State charter Fed nonmember commercial bank supervised by the FDIC

- SA State or federal charter savings association supervised by the Office of Thrift Supervision or Office of the Comptroller of the Currency

- SB State charter savings bank supervised by the FDIC

- estimated_loss – the difference between the amount disbursed from the Deposit Insurance Fund (DIF) to cover obligations to insured depositors and the amount estimated to be ultimately recovered from the liquidation of the receivership estate. Estimated losses reflect unpaid principal amounts deemed unrecoverable and do not reflect interest that may be due on the DIF’s administrative or subrogated claims should its principal be repaid in full.

- effective_date – date of failure.

- fin – Financial institute number. Another unique identifier.

- id – Institution directory number

- name – Legal name of the institution.

- total_assets – The Total assets owned by the institution, including cash, loans, securities, bank premises, and other assets as of the last Call Report or Thrift Financial Report.

- total_deposits – Total including demand deposits, money market deposits, other savings deposits, time deposits and deposits in foreign offices as of the last Call Report.

- resolution – Failure stature. Failure or assistance by merging with other institution.

- transaction_type – Resolution type. Cat 1 – Institution’s charter survives. Cat 2 – Charter terminated. Cat 3 – Payout:

- A/A – Cat1. (Assistance Transactions). Assistance was provided to the acquirer, who purchased the entire institution.

- REP – Cat1. Re-privatization, management takeover with or without assistance at takeover, followed by a sale with or without additional assistance.

- P&A – Cat2. Purchase and Assumption, where some or all of the deposits, certain other liabilities, and a portion of the assets (sometimes all of the assets) were sold to an acquirer. It was not determined if all the deposits (PA) or only the insured deposits (PI) were assumed.

- PA – Cat2. Purchase and Assumption, where the insured and uninsured deposits, certain other liabilities, and a portion of the assets were sold to an acquirer.

- PI – Cat2. Purchase and Assumption of the insured deposits only, where the traditional P&A was modified so that the acquiring institution assumed only the insured deposits.

- IDT – Cat2. Insured deposit Transfer, where the acquiring institution served as a paying agent for the insurer, established accounts on their books for depositors and often acquired some assets as well.

- ABT – Cat2. Asset-backed transfer, an FSLIC transaction that is very similar to an IDT.

- MGR – Cat2.An institution where FSLIC took over management and generally provided financial assistance. FSLIC closed down before the institution was sold. transactions

- PO – Cat3 – Payout, where the insurer paid the depositors directly and placed the assets in a liquidating receivership.

- insurance_fund – Insurance fund.

Counts of failures by year

Let’s use pandas to find the count of failures by year.

When I hear the words “by year,” I immediately think we need to group this data by year. This is like one of those word math problems that everyone hated in junior high until they understood how to convert the words to math. The same thing happens here. When your boss tells you they want “failures by year,” you should think, “I’m going to use the year column in the pandas groupby method.”

In this case, we don't have a year column. But due to the magic of datetime columns, we can access the year through the .dt accessor.

bank.effective_date0 2020-10-23

1 2020-10-16

2 2020-04-03

3 2020-02-14

4 2019-11-01

...

4099 1934-08-06

4100 1934-07-18

4101 1934-07-18

4102 1934-05-28

4103 1934-04-19

Name: effective_date, Length: 4104, dtype: datetime64[ns](bank

.groupby(bank.effective_date.dt.year)

.size()

)effective_date

1934 9

1935 25

1936 69

1937 75

1938 74

..

2015 8

2016 5

2017 8

2019 4

2020 4

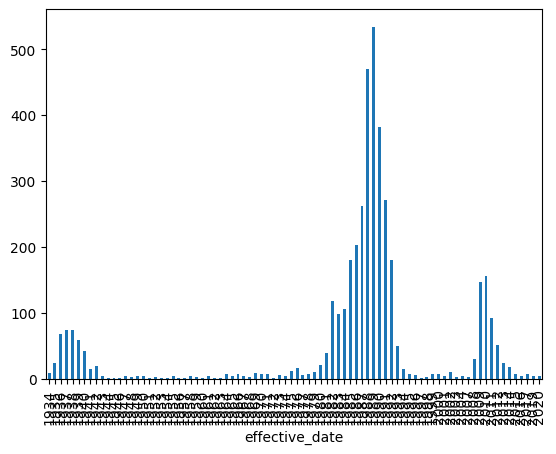

Length: 84, dtype: int64This is ok. I would prefer a visualization to this table of data. Let’s try a bar chart.

(bank

.groupby(bank.effective_date.dt.year)

.size()

.plot.bar()

)

This is a start, but the x-axis is not happy. Just be aware that if you intend on making bar plots with pandas, it converts the index to categories. In this case, the dates are converted to strings. This makes me sad, but not every library is perfect.

https://github.com/pandas-dev/pandas/issues/17001

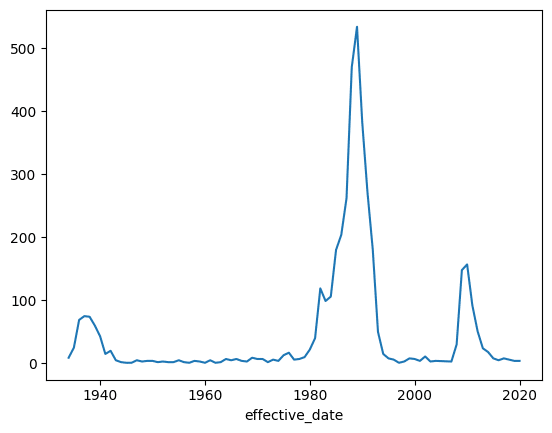

Let’s try and make a line plot instead.

(bank

.groupby(bank.effective_date.dt.year)

.size()

.plot()

)

This looks good. Line plots in pandas (unlike bar plots) respect dates in the index.

Now let’s jump into grouping functionality that is time-series specific.

Using Offset Aliases with Pandas Resample

Hidden away in the pandas documentation is a mention of offset aliases. (Sadly, these are not accessible from the docstrings inside of Jupyter, which is one lament I have with pandas otherwise excellent documentation).

You can find them here, or documented in my book, Effective Pandas.

In short,Y,Q,M,W, andDmean year, quarter, month, week, and day respectively. If you memorize these single letter shortcuts, the pandas resample method, or thepd.Grouperclass, you can quickly aggregate date information by different time intervals.

Let's try and view failures by month using the pandas resample method. Pandas resample is powerful because it lets you convert time series data with one time interval into time series data with different time intervals. You can upsample so you have more rows over shorter intervals, or downsample so you have fewer rows over longer intervals. The key to using this method is sticking a date column into the index and then calling.resampleinstead of.groupby:

(bank

.set_index('effective_date')

.resample('M')

.size()

)effective_date

1934-04-30 1

1934-05-31 1

1934-07-31 2

1934-08-31 1

1934-09-30 1

..

2019-10-31 2

2019-11-30 1

2020-02-29 1

2020-04-30 1

2020-10-31 2

Length: 540, dtype: int64Notice the index in the resulting Series. Each entry ends on the last day of the month. This is because we passed the M (month) offset alias into the pandas resample method.

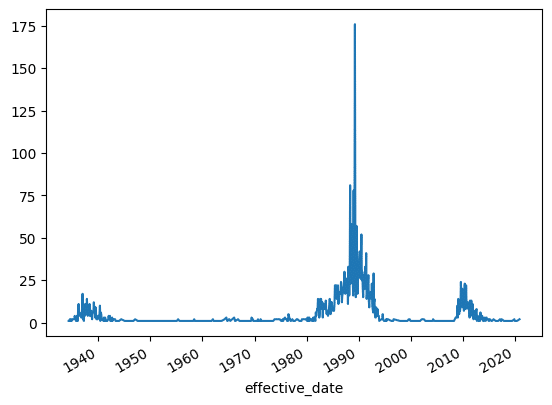

I generally plot this by chaining on a call to .plot. This will plot the date in the x-axis and draw the values in the y-axis.

(bank

.set_index('effective_date')

.resample('M')

.size()

.plot()

)

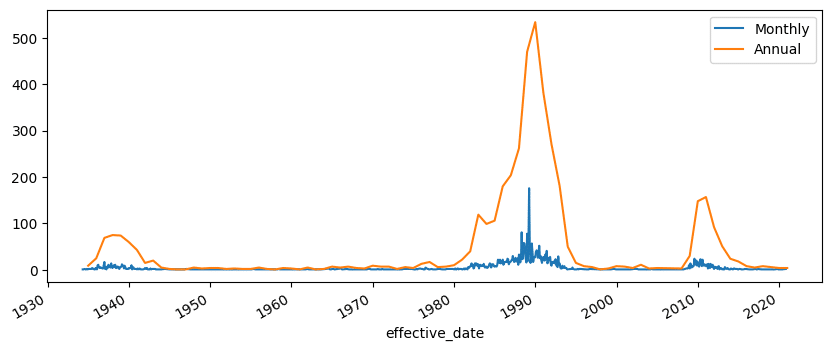

Smoothing By Rougher Aggregations Using Pandas Resample

Let’s try something a little fancier. We will make a function that plots the monthly failures (which we already saw was bumpy) and then plot the yearly aggregation on top.

I'll use the .pipe method to refactor the plotting logic into a single function.

import matplotlib.pyplot as plt

fig, ax = plt.subplots(figsize=(10,4))

def plot_monthly_and_yearly(df, ax):

(df

.resample('M')

.size()

.plot(ax=ax, label='Monthly')

)

(df

.resample('Y')

.size()

.plot(ax=ax, label='Annual')

)

ax.legend()

return df

(bank

.set_index('effective_date')

.pipe(plot_monthly_and_yearly, ax=ax)

) cert charter_class estimated_loss fin id institution total_assets total_deposits resolution transaction_type insurance_fund city state

effective_date

2020-10-23 15426.0 NM 16806.0 10538 4104 ALMENA STATE BANK 65733.0 64941 FAILURE PA DIF ALMENA KS

2020-10-16 16748.0 NM 7247.0 10537 4103 FIRST CITY BANK OF FLORIDA 136566.0 133936 FAILURE PA DIF FORT WALTON BEACH FL

2020-04-03 14361.0 NM 45913.0 10536 4102 THE FIRST STATE BANK 151808.0 143102 FAILURE PA DIF BARBOURSVILLE WV

2020-02-14 18265.0 NM 25293.0 10535 4101 ERICSON STATE BANK 100879.0 95159 FAILURE PA DIF ERICSON NE

2019-11-01 21111.0 N 1946.0 10534 4100 CITY NATIONAL BANK OF NEW JERSEY 120574.0 111234 FAILURE PA DIF NEWARK NJ

... ... ... ... ... ... ... ... ... ... ... ... ... ...

1934-08-06 NaN NM NaN 0 137 BANK OF LEWISPORT 81.0 68 FAILURE PO BIF LEWISPORT KY

1934-07-18 NaN N NaN 0 135 FIRST NATIONAL BANK OF LIMA 91.0 42 FAILURE PO BIF LIMA MT

1934-07-18 NaN NM NaN 0 136 FLORENCE DEPOSIT BANK 105.0 69 FAILURE PO BIF FLORENCE IN

1934-05-28 NaN NM NaN 0 133 FON DU LAC STATE BANK 374.0 238 FAILURE PO BIF EAST PEORIA IL

1934-04-19 NaN NM NaN 0 134 BANK OF AMERICA TRUST CO. 1435.0 1064 FAILURE PO BIF PITTSBURGH PA

4104 rows x 13 columns

Resolution Type Over Time

I want to talk about one more feature of pandas. The pd.Grouper class. I use this class to group by different frequencies of a date column without having to stick the date in the index and call pandas resample. You might ask, why?

The pandas resample method only allows us to have a single grouping. If you have played around with .groupby, then you know that you can provide multiple columns or series to groupby. In this example, let's assume this word problem:

What are the counts of the different resolution types by month?

This is a little tricky. We have “by month,” so we want to group by month, but we also really have “size by resolution type by month.”

A first stab might look like this:

(bank

.groupby([bank.effective_date.dt.month, 'resolution'])

.size()

)effective_date resolution

1 ASSISTANCE 22

FAILURE 274

2 ASSISTANCE 26

FAILURE 302

3 ASSISTANCE 32

FAILURE 443

4 ASSISTANCE 87

FAILURE 328

5 ASSISTANCE 30

FAILURE 283

6 ASSISTANCE 28

FAILURE 298

7 ASSISTANCE 48

FAILURE 359

8 ASSISTANCE 62

FAILURE 280

9 ASSISTANCE 57

FAILURE 219

10 ASSISTANCE 47

FAILURE 284

11 ASSISTANCE 30

FAILURE 212

12 ASSISTANCE 110

FAILURE 243

dtype: int64This sort of works if we want to know how many banks failed in December. But we want monthly data over time. Because we also want to group by resolution, we can't use the pandas resample method. This is where pd.Grouper comes in.

We provide the name of a datetime column and a frequency (this is that offset alias that we talked about above). The code looks like this:

(bank

.groupby([pd.Grouper(key='effective_date', freq='M'),

'resolution'])

.size()

)effective_date resolution

1934-04-30 FAILURE 1

1934-05-31 FAILURE 1

1934-07-31 FAILURE 2

1934-08-31 FAILURE 1

1934-09-30 FAILURE 1

..

2019-10-31 FAILURE 2

2019-11-30 FAILURE 1

2020-02-29 FAILURE 1

2020-04-30 FAILURE 1

2020-10-31 FAILURE 2

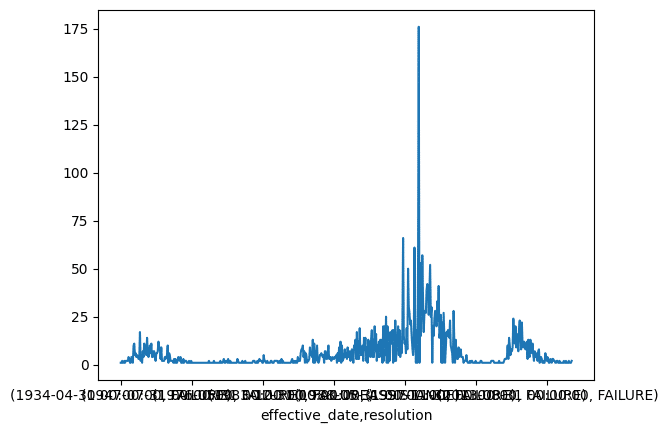

Length: 635, dtype: int64By now, you know that I want to plot this. However, tacking on .plot is unsatisfying as we have a hierarchical index and this sticks both date and resolution as a tuple in the x-axis:

(bank

.groupby([pd.Grouper(key='effective_date', freq='M'),

'resolution'])

.size()

.plot()

)

What I want to do instead is unstack the innermost index, the resolution index. The .unstack method will pull out the inner index by default and stick it up into the columns. Now we have monthly dates in the index and a column for each resolution type.

(bank

.groupby([pd.Grouper(key='effective_date', freq='M'),

'resolution'])

.size()

.unstack(level=1)

) __reduced___ASSISTANCE __reduced___FAILURE

effective_date

1934-04-30 NaN 1

1934-05-31 NaN 1

1934-07-31 NaN 2

1934-08-31 NaN 1

1934-09-30 NaN 1

... ... ...

2019-10-31 NaN 2

2019-11-30 NaN 1

2020-02-29 NaN 1

2020-04-30 NaN 1

2020-10-31 NaN 2

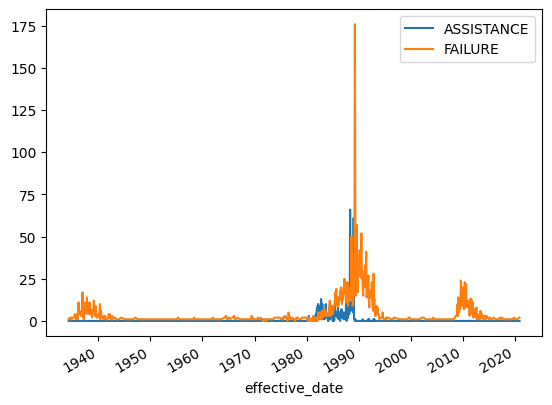

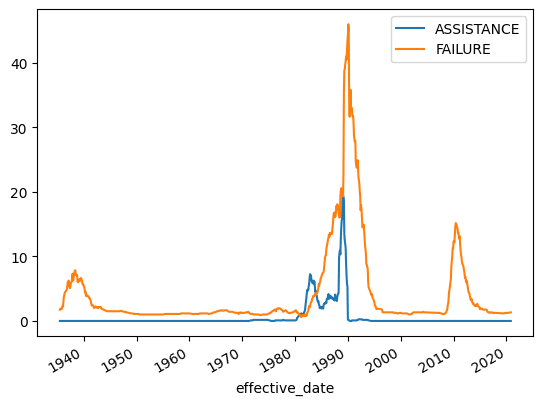

540 rows x 2 columnsIf we plot this, we will get a line for each resolution type over time. It looks like the FAILURE resolution is much more common since 1989.

def fix_cols(name):

return name.replace('__reduced___', '')

(bank

.groupby([pd.Grouper(key='effective_date', freq='M'),

'resolution'])

.size()

.unstack(level=1)

.fillna(0)

.rename(columns=fix_cols)

.plot()

)

Let’s do a 12-month rolling average to smooth this out a bit.

(bank

.groupby([pd.Grouper(key='effective_date', freq='M'),

'resolution'])

.size()

.unstack(level=1)

.rename(columns=fix_cols)

.fillna(0)

.rolling(12)

.mean()

.plot()

)

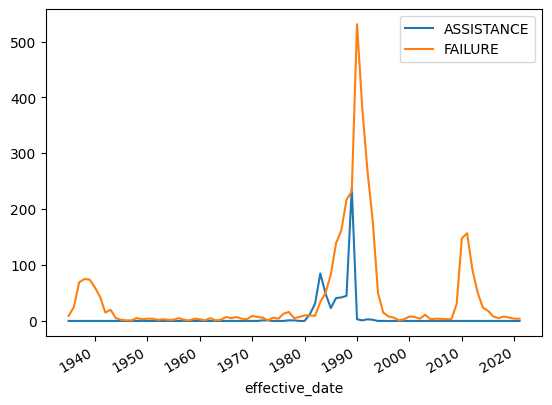

Below I plot the yearly resolution size. Again, you can see that the basic shape is the same, but the yearly rolling average tells a better story.

(bank

.groupby([pd.Grouper(key='effective_date', freq='Y'),

'resolution'])

.size()

.unstack(level=1)

.rename(columns=fix_cols)

.fillna(0)

.plot()

)

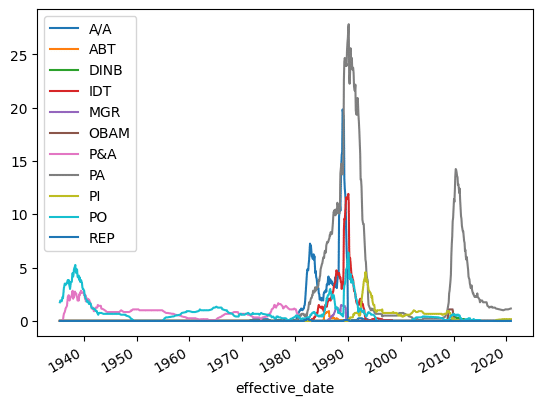

And finally, let’s look at the 12-month rolling average by resolution type.

(bank

.groupby([pd.Grouper(key='effective_date', freq='M'),

'transaction_type'])

.size()

.unstack(level=1)

.rename(columns=fix_cols)

.fillna(0)

.rolling(12)

.mean()

.plot()

)

Now You Have Pandas Resample, Groupby, and Rolling Superpowers

I hope that this blog post exposed you to the powerful time series functionality in pandas, particularly pandas resample, groupby, and rolling.

Folks often ask me why I use pandas to manipulate my data. Could I do this in SQL? Yes… probably. But I’ve written enough SQL in my life to know that it wouldn’t be fun for me. Are you out of luck if your data is in a database or data warehouse? Nope, If you want to take advantage of this power for your data in Snowflake or BigQuery, try Ponder today! You get to leverage the easy syntax of pandas, but run it on your data warehouse.